santa clara county property tax credit card fee

A non-refundable processing fee of 110 is required in Santa. Santa clara county property tax credit card fee Sunday July 3 2022 Edit.

Credit Card Debit Card Service Fees Oc Treasurer Tax Collector

BOX 49067 San Jose CA 95161-9067.

. Santa Clara County 1800. If you elect to pay by credit card please be aware that these fees are added to your transaction. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Valuation Based Fee Table for Building Permit Review. Confidential Marriage License 8300 Pay with cash check or creditdebit card 250 convenience. The fee to use a credit card will vary based on your county but theyre almost always at least 2 and often more than 25 of the total tax amount.

Residents of the county can. For example LA County. There is an internet payment fee charged in addition to the property tax amount you pay.

1110 of Assessed Home Value. 0 Down VA Loan. What are the property taxes in Santa Clara County.

0720 of Assessed Home Value. Pay in Person. In Santa Cruz County a home is worth 711000 on average with 54 of the assessed value subject to property tax.

City of Santa Clara Municipal Utilities PO. The average property tax rate in Santa Clara County is 067 of the market value of the home which is below the state average of 074 statewide. Clara Old License And Certificate Of Marriage Signed By Brenda Davis Marriage Signs Lease.

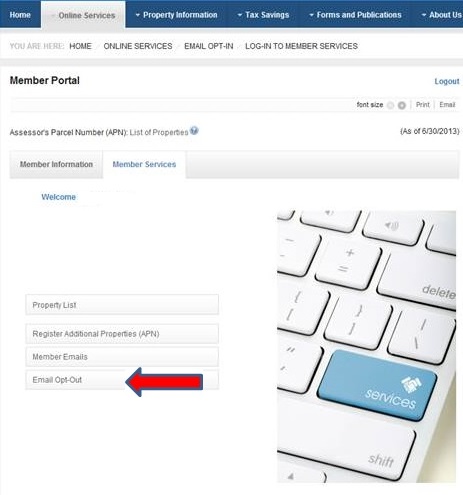

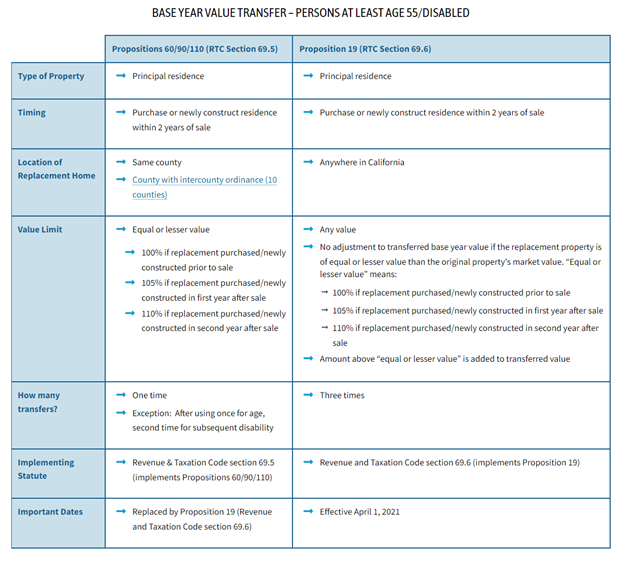

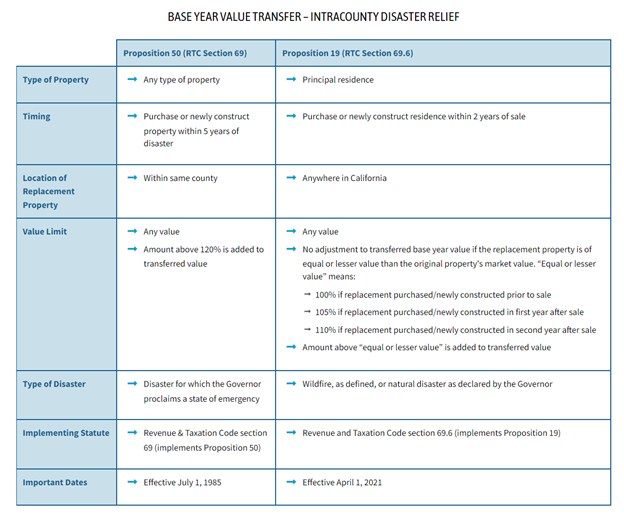

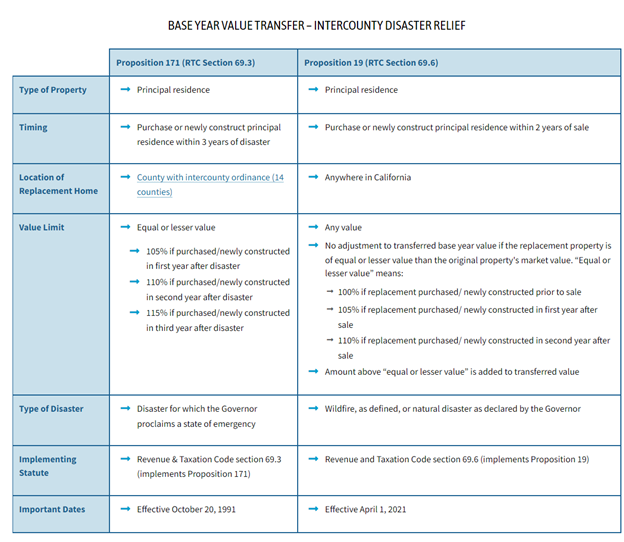

Valuation Based Fee Schedule. Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located. There is no fee for internet payments in Santa Cruz County.

City of Santa Clara Municipal Utilities PO. Valuation Based Fee Table for Building Permit Review. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed.

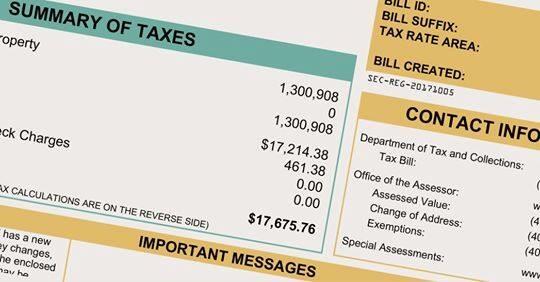

SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the first installment of the 2022-2023 property. Pay with cash check money order credit or debit card in person at the Municipal Service. Enter Property Parcel Number APN.

We accept payments of cash checks and credit cards Subject to. A convenience fee charged by the credit card company is passed on to the. 0740 of Assessed Home Value.

Santa clara county property tax credit card fee Sunday August 28 2022 Edit.

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Standards And Services Division

Reminder First Installment Of 2018 2019 Property Taxes Due Nov 1 County Of Santa Clara Mdash Nextdoor Nextdoor

Innovation At Work Scclab County Of Santa Clara

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

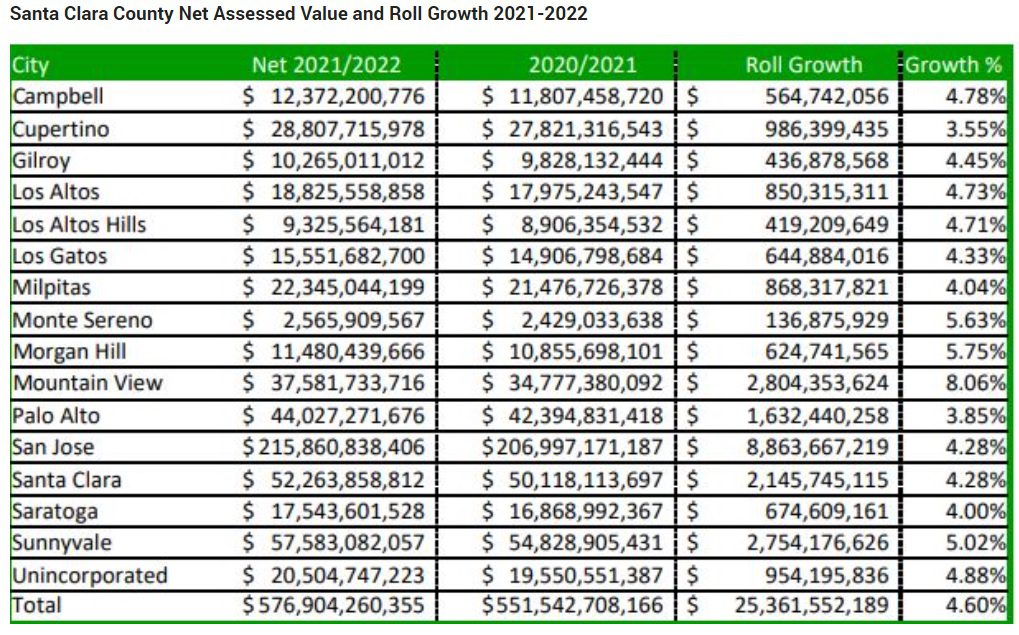

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Property Tax Payment Treasurer Tax Collector

Property Taxes Lookup Alameda County S Official Website

Standards And Services Division

Property Tax Mobile App Department Of Tax And Collections County Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

Property Taxes Department Of Tax And Collections County Of Santa Clara

Taxes In Bankruptcy Discharge Eliminate Law Office Of Mark J Markus Bankruptcy Attorney

Standards And Services Division

Santa Clara County Property Tax Getjerry Com

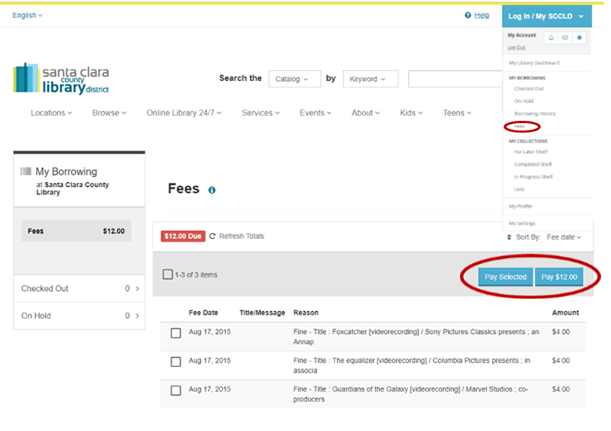

Pay Fees Or Donate Santa Clara County Library District